How Financial Advisor Brisbane can Save You Time, Stress, and Money.

Table of ContentsWhat Does Financial Advisor Brisbane Do?Some Ideas on Financial Advisor Brisbane You Need To KnowSome Known Factual Statements About Financial Advisor Brisbane Indicators on Financial Advisor Brisbane You Need To Know10 Simple Techniques For Financial Advisor BrisbaneGetting My Financial Advisor Brisbane To Work

An effective financial consultant has expert expertise of financial investments, financial savings and cash management however additionally has wonderful people skillsAs a financial advisor, you'll give clients with expert recommendations on exactly how to manage their cash. You'll require to investigate the industry to ensure that you can suggest one of the most appropriate product or services readily available and after that protect a sale with the client.

Facts About Financial Advisor Brisbane Uncovered

All advisors should inform their clients, before giving suggestions, whether they provide independent or restricted recommendations. Your tasks will certainly differ depending on your role yet normally you'll need to: contact customers and set up meetings, either within an office environment or in customers' homes or organization premisesconduct comprehensive testimonials of clients' monetary circumstances, existing stipulation and future aimsanalyse information and prepare strategies finest suited to specific clients' requirementscomplete risk analysesresearch the marketplace and provide customers with details on brand-new and current items and servicesdesign monetary strategiesassist customers to make educated decisionsresearch details from numerous resources, consisting of companies of monetary productsreview and respond to clients altering demands and economic circumstancespromote and sell economic items to meet given or bargained sales targetsnegotiate with item vendors for the ideal feasible ratesliaise with head office and financial services providerscommunicate with various other professionals, such as estate representatives, lawyers and valuerskeep up to day with monetary products and legislationproduce financial reportscontact clients with information of new financial products or changes to regulation that might impact their cost savings and investmentsmeet the regulatory aspects of the duty, e.g.

4 Simple Techniques For Financial Advisor Brisbane

Income figures are numbers as a guide onlyOverview Versatility is called for if working for a banking contact centre or as an independent monetary consultant (IFA), as customers may call for evening and weekend break conferences.

Self-employment is common. There are openings for restricted and independent consultants throughout the UK. Personal financial settings have a tendency to be based in London and other key monetary locations such as Belfast, Edinburgh and Manchester. Travel within a working day prevails for IFAs, however over night steer clear of from home are unusual.

Pre-entry job experience is helpful as it description shows prospective companies that you have some of the required skills as well as a passion in the location. Pertinent work can include sales, advising or customer service functions, or anything that provides you some industrial understanding. You might also try to find work experience opportunities in high road financial institutions.

An Unbiased View of Financial Advisor Brisbane

Financial advisers generally work for: financial institutions and building societiesfinancial planning firmsindependent economic recommendations companiesinsurance companiesinvestment firms. It's likewise possible to discover work in estate firms, expert pension plan working as a consultants, legislation firms and with a number of sellers that have created monetary services as a component of their business.

There might additionally be possibilities to become a supervisor or partner in your firm. Self-employment is another alternative. It's fairly typical for financial sales professionals with successful work experience to launch their own organizations as independent economic advisers (IFAs). You must remain to establish your abilities and knowledge throughout your job.

All about Financial Advisor Brisbane

Advisors also check their development. They make changes and remain on track to accomplishing financial purposes. Financial advisors assist customers make educated decisions. visit site It can build long-lasting economic well-being. There are a number of access level financial advisor tasks readily available for you to give it a try. If you need to know all about this satisfying career, keep analysis.

Financial advisors offer go advice on financial investment choices. Financial consultants research study market patterns. They consider factors like existing financial savings, costs, and expected lifespan.: Financial consultant job summary needs assisting customers handle monetary risks.

Fascination About Financial Advisor Brisbane

A monetary consultant assesses financial plans. It assists customers adjust to transforming monetary scenarios. Advisors enlighten clients about monetary concepts. Financial Advisor Brisbane.

Financial consultant job description requires complying with stringent moral criteria. Being a monetary consultant needs a combination of abilities.

Rider Strong Then & Now!

Rider Strong Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Danny Pintauro Then & Now!

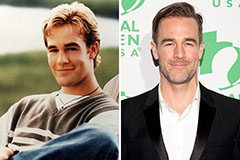

Danny Pintauro Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!